We shape,

We invest,

We empower…

The next generation of female founded unicorns

The founders of the future will look fundamentally different - more diverse, more female.

We back founders who are challenging the status quo, changing how we work, manage our health, grow our wealth, and live more sustainably.

Impact

175

Companies

£250m

Raised by Sie Companies

175

Checks from Sie Investor Community

For Investors

We are building an ecosystem across Europe where investors can back the next generation of founders. Invest via Sie SPVs, get involved in Sie Programs and back exceptional companies. Join as Angel or Family Office.

For Founders

We are changing the face of the tech ecosystem by reducing the gender funding gap and driving more capital to diverse founding teams. Apply for our Funding Programs if you are looking to raise your next investment round.

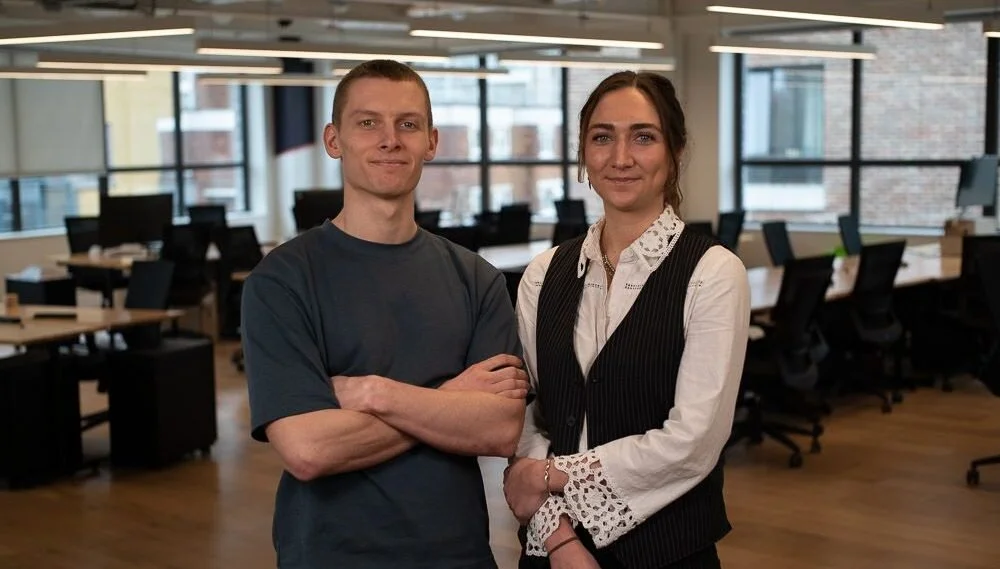

Founder of Cino

“What I genuinely appreciated from Sie Ventures was the guidance through the fundraising rollercoaster. From stories of past founders to focused 1:1s, it helped us push through the toughest parts and brought clarity when things got messy. The support & mentorship gave us not just investor access, but the mental edge and strategic clarity to know where to double down and how to win.”

Latest from Sie

-

![Sie Ventures invests in Biographica's £7m seed round]()

Sie Ventures invests in Biographica's £7m Seed round to dramatically accelerate crop improvement using AI

We’re very excited to share our investment into Biographica’s £7m seed round, led by Faber and joined by SuperSeed, Cardumen Capital,The Helm, EQT Foundation amongst other existing investors and angels.

Biographica is using AI and machine learning to dramatically accelerate crop improvement - helping seed companies identify high-value genetic targets for traits like yield, resilience and nutrition far faster than traditional R&D.

-

![]()

Sie Ventures invests in Emm's $9M Seed round to create one of the world’s first ‘smart’ menstrual cups

We’re excited to announce our investment into Emm’s $9M (£6.8 million) Seed round, led by Lunar Ventures and joined by Alumni Ventures and Labcorp Venture Fund.

Emm has developed a smart menstrual cup made from medical-grade silicone and embedded with ultra-thin sensor technology to track reproductive and menstrual insights, think of it as an Oura Ring for menstrual health.

Read more → -

![]()

Sie Ventures announces investment in FitCollective £3M Pre-Seed round

We are excited to back Fit Collective, led by Sie Catalyst VI founder Phoebe Gormley, in their £3M Pre-seed.

Fit Collective is building an AI co-pilot for fashion brands analysing data on returns, fabric behaviour, and sales before a single garment is made. The result? Less waste, higher margins, and clothes that finally fit real people, not just sample sizes.

Read more → -

![]()

LegalOn Acquires Sequoia-Backed Fides Technology - Sie Ventures Portfolio Company

LegalOn Technologies, a global leader in legal AI, has completed the acquisition of Fides Technology, a governance and entity management software firm backed by Sequoia Capital. Fides Technologies is Portfolio company of Sie Ventures.

Read more → -

![]()

Our Portfolio Founder Sarah Blagden is involved in the world’s first trial of a vaccine to prevent lung cancer

Prenostics, a company we invested in applies technology to detect the earliest stages of cancer, long before any other method can diagnose cancer today. Sarah is also ilved in ‘LungVax’ Project, a new vaccine developed by University of Oxford and UCL to prevent lung cancer.

Read more → -

![SpaceDOTS]()

SpaceDOTS raises $1.5M Seed

Our portfolio company SpaceDOTS close a $1.5M seed round (led by Female Founders Fund) to expand their UK & US teams and advance their mission: building the SKY-I platform to detect and interpret orbital threats, helping spacecraft operators protect missions and infrastructure.

Read more → -

![]()

Sie Ventures invests in Okko Health

We’re thrilled to announce our investment in OKKO Healthed by Topcon Healthcare, a global leader in ophthalmic med‑tech and digital health.

We’re proud to co‑invest alongside Bayer, Dieter von Holtzbrinck Ventures, Lavender Ventures, Deuce Capital, and an incredible network of angels.

OKKO’s digital vision tests, delivered as puzzle games, provide quantifiable data on visual function and serve as a safety net for patients at risk of macular disease.

Read more → -

![]()

We won Accelerator of the Year Award!

We are very excited to share that Sie Ventures has won Accelerator of the Year Award by UKBAA. It was only last year when we were awarded the Angel Group of the Year Award.

We are truly honoured and grateful for the support and recognition from the UK ecosystem.

Our female founders have collectively raised over £200M with our support. They continue to inspire us, and we’re not stopping here!

Read more → -

![]()

We have launched Sie Foundations!

We have launched a new program: Sie Foundations and we continue running Sie Catalyst: two distinct but connected programs that meet founders where they are and help them move forward with clarity, confidence, and the right support at the right time.

Whether you’re just getting started with fundraising or gearing up for a round, here’s how these programs are designed to work together.

Read more → -

![]()

Sie Ventures Syndicate has been selected as one of five angel syndicates in the UK to co-invest £7 million alongside the British Business Bank

The British Business Bank has committed £7 million to a new platform enabling it to invest alongside five of the UK’s promising and emerging angel syndicates, facilitated by Haatch.

Sie Ventures are proud to be one of only two female-led angel groups participating in this landmark initiative.

Read more → -

![]()

Sie Catalyst Announces Cohort VI

Sie Ventures kicks off Catalyst VI Cohort with a remarkable group of FinTech, DeepTech, Sustainability, Future of Work, and B2B SaaS founders.

Read more → -

![]()

Sie Ventures Invests in Cino

Sie Ventures Catalyst V alumni, Elena Churilova and Lina Saleh—founders of Cino— close €3.5m seed round led by Balderton Capital alongside Connect Ventures, Tera Ventures, APX and Sie Ventures.

Cino cracks bill-splitting at the moment of payment, raises seed round

Read more → -

![]()

Apply for Impact Bootcamp

We are collaborating with Amazon Web Services (AWS) in the UK to run an exclusive 2-day in-person Impact Bootcamp, on November 4th & 5th in London, crafted specifically for diverse founding teams planning to raise at pre-seed or seed stage.

Read More > -

![]()

Sie Ventures Announces 2024/2025 Partners and Launches Catalyst Cohort V

We are thrilled to introduce the Sie Catalyst Cohort V and our Catalyst Program Partners for the 2024/2025 term - Marriott Harrison, HSBC Innovation Banking, Cooper Parry and British Business Bank

Read More > -

![]()

Sie Ventures Syndicate Wins Angel Group of the Year Award

We’re thrilled to announce we have been selected as the winner of the Angel Group of the Year at UKABAA Investment Awards 2024! This award recognises the most active and impactful angel investors group in the UK, making not only a significant number of investments in the companies during the past year, but bringing strong added value to support the growth and success of the companies.

Read more → -

![]()

How Ovom Secured Investment From Ananda Impact Ventures Through Sie Ventures’ Catalyst Program

Felicia von Reden, co-founder of Ovom Care, participated in Sie Ventures’ fourth Catalyst program in Autumn 2023 and recently announced their €4.8M Seed round, after meeting through Sie Ventures’ Catalyst Program. Ananda Impact Ventures invested in Ovom’s Seed Round.

Read More > -

![]()

Our Search For Sie Ventures’ 5th Catalyst Program Cohort Members: What We’re Looking For

For the past four years, the Sie Ventures team, alongside our network of VCs and Angels, has spearheaded Catalyst, our flagship fundraising program for diverse founding teams. Collectively, Sie Founders have raised an impressive £114M. Now, we’re thrilled to introduce Catalyst V! Here’s a breakdown of our criteria and what to anticipate during the application process.

Read more → -

![]()

Why Sie Ventures Invested in By Rotation

Fashion — and its supply chain — is the largest polluting industry after food and construction. By Rotation is a global social network for peer-to-peer rental, providing its community with access to premium items at affordable prices. Sie Ventures is excited to invest in By Rotation and support Eshita and the team on their mission to challenge and transform overconsumption habits.

-

![]()

Levelling the playing field, a profile of Sie Ventures

At Sie Ventures, we’re levelling the playing field by backing diverse founding teams and founders who are building companies solving world’s most pressing problems. We invest alongside our network of angel investors and family offices, as well as run programs, providing better access to network, education, capital and support.

Read more → -

![]()

Sie Ventures European FemTech Report

Sie Ventures has created an expansive European FemTech market map including key findings, shaped by data collected from over 540 active femtech companies at various stages from pre-seed up to IPO.

Enter your details below to receive your copy of the report.

Read more → -

![]()

Sie Raise Summit: Recap

On March 19th, we hosted our second Sie Raise Summit in London ~ a one-day event entirely dedicated to demystifying the fundraising process. We selected 20 exceptional founders to attend various sessions filled with expert insights, unfiltered discussions and valuable networking opportunities with top tier investors.

Read more → -

![]()

Why Sie Ventures Invested in Shellworks

Sie Ventures is excited to invest in Shellworks and support the team on their journey to build a more sustainable future for the packaging industry. Shellworks is a producer of Vivomer — the material of the future — made and unmade by microbes. Their vision is to break the reliance on the petroleum industry by building a new standard of packaging that is performant, cost-competitive, and truly sustainable.

Read more → -

![]()

How to Find Your Technical Co-Founder

Are you a non-technical founder looking for your technical co-founder? Join AWS and Sie Ventures for an educational morning, discussing the common pitfalls and mistakes encountered by founders on the search and why a technical co-founder can be the difference between receiving venture capital or not.

Read more → -

![5th Dimension AI]()

Why Sie Ventures invested in Fifth Dimension AI

Despite persisting sluggish deal activity, the VC activity around generative AI has been strong. We we are thrilled to announce our first AI investment into Fifth Dimension AI (5D AI), which raised £2.3M led by Seedcamp.

Read more → -

![Anansi]()

Why Sie Ventures invested in Anansi

We're delighted to announce our latest investment into Anansi. Co-founders Megan & Ana joined our first cohort in 2021 and we've been incredibly impressed by their growth to date. They are already solving this huge problem in the UK, with European and US expansion on the road-map next. We can't wait to support you on this journey!

Read more → -

![Sie Catalyst]()

Sie Catalyst program kicked off its 4th Cohort.

We kicked off our fourth Sie Catalyst Program in September with 11 exceptional companies across UK and Europe. We were also joined by the formidable Michelle Kennedy, Founder & CEO of Peanut who shared her learnings on fundraising, hiring, culture and building Peanut.

Read more → -

![Jude]()

Why Sie Ventures invested in Jude

We're delighted to share more about our latest investment into Jude - most notably that they are first movers, creating the bladder care category and serving the 2.3 billion bladder suffers globally. Jude raised $4.24m, led by Eka Ventures.

Read more → -

![]()

Demystifying Venture Capital Term Sheets: Benchmarks, Market Terms, Negotiations

We co-hosted a discussion with Marriott Harrison and HSBC Innovation Banking on Term Sheets. We discussed key market trends and benchmarks so that founders are better equipped with the industry standard and to help combat the asymmetry of information between founders and investors.

Read more → -

![SpaceDOTS]()

Why we Invested in Space DOTS?

Space DOTS is on a mission to disrupt the $18bn Space R&D and Testing market to ensure more effectiveness in the advanced materials used to build products deployed into space, while reducing debris in space. Find out more about our investment in SpaceDOTS

Read more → -

![]()

Re-Fresh Global raises €1.1 million in pre-seed round

Sie Catalyst Cohort III portfolio company Re-Fresh Global raises €1.1 million in pre-seed round to transform discarded clothing/textiles into new raw materials including nanocellulose, bioethanol, and multifunctional fibers, the investment will further R&D activities.

-

![]()

Angel investing alongside VCs while driving more wealth to more diverse founders

150+ angels in the Sie Syndicate Angel Network are actively co-investing in Europe’s most promising female-led startups.

Read more → -

![]()

Our Partners SVB UK Re-launch as HSBC Innovation Banking

Our trusted partners, SVB UK rebrand to HSBC Innovation Banking. SVB UK have been an integral part of the UK startup community, acting as a trusted partner and providing unwavering support to thousands of startups in the UK venture ecosystem.

Read more → -

![]()

Looking for the most promising female-led ventures in the UK and Europe — Sie Catalyst IV applications are open!

We have officially opened applications to Sie Catalyst IV, kicking off in September 2023. More than half of our last cohort closed rounds during the program, despite tough market conditions, with the remainder in the process of closing now.

Read more → -

![]()

Your Juno partners with Wealthify to bring financial education to women and non-binary people

Our portfolio company Your Juno is partnering with Wealthify to continue helping women and non-binary people gain financial confidence.

Read more → -

![]()

Sie Raise Summit - 1-day event focused entirely on fundraising.

Sie Raise Summit is designed to demystify the fundraising process. Our goal is to provide equal access to capital and network and set you up for success in raising your next round.

Read more → -

![]()

What To Expect From Fundraising in 2023 | With Marriott Harrison

We sat down with Fran Spooner — Partner at Marriott Harrison, valued partner of Sie Ventures — to discuss what founders should be prepared for as they go out to fundraise in 2023.

Read more → -

![]()

Why Sie Ventures invested in Grünfin

Founded by the founding team of Wise and ex-banking executives, Grünfin has set out to make sustainable investing into a values-based portfolio, simple and accessible, for anyone able to invest from 100€ per month. Read more about why we invested in Estonian based Grünfin,

Read more → -

![Citi Ventures & Sie Ventures]()

Toward gender equity in startup funding: Conversation with Citi Ventures and Sie Ventures

Our founding partner, Triin Linamagi and Jelena Zec from Citi Ventures, valued partners of our latest program discuss why both the tech industry and the world could benefit from funding more diverse teams, particularly women and what can we do to change the landscape.

Read More → -

![]()

The opportunities in backing diverse founding teams

"if banks and other financial service providers catered for women at the same rate as they do to men, they could generate an additional $700bn global in annual revenue". One of many statistics in this interview with our founding partner, Triin Linamagi that highlight the opportunities in backing diverse founding teams.

Read more → -

![]()

Demystifying Fundraising from Venture Capitalists

We wrapped up our third Catalyst Program - designed to drive more cheques to female founders, make fundraising less painful and unlock access to Venture Capital. A key part of our program is to pair VCs and founders who work together over three months. We wanted to share our learnings with you.

Read more → -

![]()

Why Sie Ventures invested in Rosaly

Rosaly is creating a solution that boosts financial wellbeing of employees while increasing employee commitment and reducing financial stress in an underserved market. Read why we invested in Rosaly, how we helped her to find a lead investor and diversify the cap table.

Read more → -

![]()

Ketoswiss raises $4M to expand to the US and propel R&D

KetoSwiss AG led by Dr. Elena Gross has secured $4M funding round to propel their R&D and expand to US market. KetoSwiss is developing a new therapeutic product mitigating neurological diseases such as migraines and brain aging. Elena started Ketoswiss having suffered from chronic migraines herself and now their on track to help many others.

Read more → -

![]()

Our Cohort II company Muse raises $20M to help UK business owners with short-term cash flow

Muse (Cohort II), SME financial services app has raised $20m (£17m) in a debt facility round to continue its growth in the UK and expand its offerings abroad. Muse Finance provides various financial services for small businesses, including loans along with cash flow and invoice management tools.

Read more → -

![]()

How female investors are challenging the funding gap

Sie Ventures aims to plug the shortfall in venture capital for women-led businesses and give backers better access to founding teams from diverse backgrounds. Find out more about us from Financial Times.

Read more → -

Investor network Sie Ventures wants to plug the funding gap for female founders.

Sie does not only exist to drive capital to female founders but to democratise early-stage investing and attract more women to the world of venture funding. Find out more from our interview with Business Insider.

Read more → -

![]()

iLoF closes $5M to accelerate personalised drug discovery

Excited to announce that our Cohort I company iLoF has closed a $5M round to accelerate personalised drug discovery. iLoF is developing a platform that creates improved access to personalised medicine for millions of people around the world living with complex diseases.

Read More → -

![]()

Fundraising In a Market Downturn

It’s turbulent times for startups raising capital right now and Sie Ventures is even more committed supporting founders navigating their way through it.

We hosted a session in partnership with Silicon Valley Bank discussing the current funding landscape and how the economy and public markets are impacting the venture capital market.

Read more → -

![]()

Applications Open for Catalyst Program

Sie Ventures Catalyst Program Launches Third Cohort to Level the Playing Field for Female Founders Across Europe. The program is supported by Silicon Valley Bank, AWS, Citi Ventures, Marriott Harrison.

Read more → -

![]()

Why Sie Ventures Invested in Juno

With over $30 trillion in wealth transfer occurring over the next decade, women will soon control more than half the world’s wealth and they’ll want to know the best ways to invest it. Find out why we invested in Juno

Read more → -

![]()

Fundraising Stories: Meet Anansi

Meet our Cohort I founder Meghan Bingham-Walker from Anansi whose goal is to modernise insurtech. Megan shares her journey on building a company in the insurtech industry and provides an insight into the lessons and challenges she's faced on her fundraising journey.

-

![]()

Apryl Raises €4.1 Million

Apryl raises €4.1 Million to bring fertility benefits to the workplace. Massive congrats to Jenny Saft and Tobias Kaufhold from apryl on closing their Seed round. Starting a family should be a right – not a privilege.

-

![]()

Frontman Raises $1.2 Million

Really excited to announce that Annelise Hillmann and Nick Bunn from Frontman (Sie Cohort I) have closed a $1.2M seed to redefine male grooming. Read More →

Read More → -

![]()

Why We Need to Invest in Female-Led Businesses

Excited to have collaborated with Citi on their latest report on women entrepreneurship, and share why we need to invest in more female led businesses.

Read More → -

![]()

Your Juno Raises $2.2 Million

We are beyond excited to join the journey with Margot de Broglie and Alexia de Broglie from Your Juno alongside our angel investors at Sie Ventures to close the gender gap in financial education, and make it more inclusive and accessible.

-

![]()

SPOKE Raises $1.5M Led By Ada Ventures

SPOKE, one of Sie Cohort I companies has closed $1.5M led by Ada Ventures. Spoke brings together the seemingly opposing worlds of music culture and mental health.

Read more → -

![]()

Break The Love Secured $2.5M

Our Cohort I company Break The Love founded by Trisha Goyal has secured $2.5M in funding to democratise access to recreational tennis. The round is led by Lake Nona, an early-stage VC primarily backed by the Dassler family of Adidas fame and Joe Lewis.

Read More → -

![]()

Fundraising Stories: Meet Mirza

Meet our Cohort I founder Siran Cao from Mirza who is on a mission to “change the math” for caregiving. Siran shares her journey on what led her to build Mirza, experiences of raising both in the UK and the US, and the valuable lessons she learned throughout her fundraising journey.

-

![]()

Juno Closes Their Pre-Seed Round

Margot and Alexia de Broglie from Sie Cohort II have launched a new 'financial literacy' app for women — and they're already looking to go global. They quit their jobs to build 'The Duolingo of finance" with a mission to tackle the gender financial literacy and confidence gap.

-

![]()

Jove Raises £600K Pre-Seed Round

Jove is an InsurTech company that was part of Sie Cohort I. We're seeing the new wave of women-led insurtechs, with Jove building a bundle of “fit for purpose” insurance products for drivers, freelancers, and consultants that's embedded into marketplaces and apps to make coverage automatic.

-

![]()

Anansi Raises £1.5M Seed Round

Sie Cohort I company Anansi raised £1.5M seed funding led by Octopus Ventures. Anansi is an automated insurance platform enabling customers to get coverage and receive claims directly into their bank accounts via open banking.

-

![]()

What our First Cohort Achieved in 6 Months

We launched the Sie Capital Platform to drive more capital towards female founders and in our first 6 months our first cohort’s already raised over £10M. And the best part is… we’re only getting started.

-

![]()

Yuty Secures £500K in Pre-Seed Funding

Our Cohort I company Yuty has secured £500k in pre-seed funding. With Black female founders receiving just 0.02% of VC funding in the UK, it’s only the 10th business in the UK launched by a Black female founder to gain VC backing, according to the founder.

-

![]()

ESG in VC Interview with Nicole Velho

Less than 2% of global venture funding goes to female-led businesses, however, female-led businesses outperform those led by an all-male team by 250%. Sie Co-Founder Nicole Velho talks to BFP about diversity in Venture Capital.

-

![]()

Early Stage Founders are Missing Out

The number of early stage deals, and the amount of capital invested at an early stage in Europe, is declining, data shows. Our Co-Founder Nicole Velho talks with Sifted about early stage investing in Europe and what can be improved.

-

![]()

UK’s Top Fifty Most Inspirational Women in Technology

Sie Co-Founder Triin Linamagi was recognised as one of the UK’s top fifty most inspirational women in technology by AccelerateHer, announced in the Financial Times.

-

![]()

Evaluating Early-Stage Startup Potential

Miruna Girtu from Syndicate Room who is also Venture Community Member at Sie is interviewing investors for Forbes: the 33 questions asked from early stage founders. Here’s how to prepare for the toughest questions..

-

![]()

Sie Interview with NBC

Sie Co- Founder Triin Linamagi had an opportunity to speak with Zoraida Sambolin, an Emmy winning journalist and co-anchor of NBC 5 News about female entrepreneurs, and the importance of the support and network to access capital.

-

![]()

Why We Built Sie

It is now 2022 and, still, less than 2% of global venture funding goes to female-led businesses. However, female-led businesses across the board have generated 250% greater returns per dollar invested, compared to those led by an all-male team.

As Seen in

Subscribe to our newsletter

Get updates on new funds launched, fundraising insights, events, important program dates and more…